unified estate and gift tax credit 2020

As of 2021 married couples can exempt 234 million. The previous limit for 2020 was 1158 million.

Insolvency Professional And Its Role Under Ibc 2016 Insolvency Limited Liability Partnership Company Secretary Polis Signs 270 Million Small Business Loan And Grant Programs Into Law Denver Busin Small Business Loans Small Business Development Center Business Journal.

. Expert Solution Want to see the full answer. This is called the unified credit. Unified estate and gift tax credit 2020 Tuesday March 15 2022 Edit.

The previous limit for 2020 was 1158 million. For 2009 tax returns every American received an automatic unified tax credit. The Internal Revenue Service announced today the official estate and gift tax limits for 2020.

How did the tax reform law change gift and estate taxes. For 2021 that lifetime exemption amount is 117 million. The April 15 2020 deadline is postponed to July 15 2020.

The unified estate and gift tax credit exempts people with taxable estates under 117 million from paying any estate taxes at all. Unified estate and gift tax credit is the current shelter amount for gifting during ones lifetime and at ones death. The tax is then reduced by the available unified credit.

Citizen received the same exemption credit so that you could as a couple give a full 7 million to your heirs free of the estate taxThere was no estate tax on the first 35 million in 2009 meaning you were not required to pay taxes until the. Gift Tax Marital Deduction Many charitable remainder trusts provide for annu-ity or unitrust amount payments to be made to the donor and spouse until the death of both. It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has.

The tax credit unifies the gift and estate taxes into one tax system that decreases the tax bill of the individual or estate dollar for dollar. The estate and gift tax exemption is. For 2020 US residents and citizens are entitled to a US estate tax unified credit of approximately 4577800 which essentially exempts 1158 million of property from estate tax.

The means that their families will. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of. This is called the unified credit.

Check out a sample QA here See Solution star_border Students whove seen this question also like. For 2021 the estate and gift tax exemption stands at 117 million per person. A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure.

Then there is the exemption for gifts and estate taxes. The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise subject to either the gift tax or the estate tax and a tax credit ie it reduces the amount of tax owed. Thats up 72000 from what it was for those who passed away in 2019.

A married couple can transfer twice that amount to children or others or 228 million. In 2022 couples can exempt 2412 million. Income Tax Fundamentals 2020.

The IRS announced new estate and gift tax limits for 2021 during the fall of 2020. Gifts and estate transfers that exceed 1206 million are subject to tax. The recipient typically owes no taxes and doesnt have.

In this notice the Treasury Department and IRS are providing relief to all taxpayers who have Federal gift and generation-skipping transfer tax returns and payments due on April 15 2020. The Unified Tax Credit Individuals who gift large amounts while still living may be required to pay the gift tax and assets left to beneficiaries may be subject to estate tax. You can give up to this amount in money or property to any individual per year without incurring a gift tax.

Under the tax reform law the increase is only temporary. Please call our offices at 800 843-8114. The tax reform law doubled the BEA for tax-years 2018 through 2025.

The annual gift tax exclusion is 16000 for tax year 2022 up from 15000 from 2018 through 2021. Your gifts can total 30000 for the year if you want to give two people each the annual exclusion amount. Gift and Estate Tax Exemptions The Unified Credit.

Currently you can give any number of people up to 16000 each in a single year without incurring a taxable gift 32000 for spouses splitting giftsup from 15000 for 2021. The amount of the Unified Credit is currently higher than it has ever been while an estate tax is. For most middle-class American families their estate will always fall under the unified credit amount.

Beginning in 2022 the annual gift exclusion will be 16000 per doner up from 15000 in recent years. What is the unified credit for estate and gift taxes. Take 345800 and add in 40 of the 1058 million excess and you get a total unified credit of 4577800.

The income tax gift tax and estate tax consequences of any trust for the Institute a client may want to con-sider. The IRS announced new estate and gift tax limits for 2021 during the fall of 2020. Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million and for 2020 the BEA is 1158 million.

The unified credit is per person but a married couple can combine their exemptions. The unified estate and gift tax credit exempts people with taxable estates under 117 million from paying any estate taxes at all. If you were married your spouse also a US.

For 2022 the lifetime gift and estate exemptions increased to 1206 million per individual and 2412 million for married couples. The previous limit for 2020 was 1158 million. The annual exclusion amount for 2020 is 15000 per person.

The unified tax credit is designed to decrease the tax bill of the individual or estate. Should the exemption be set higher. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000.

The unified tax credit has a set amount that an individual can gift during their lifetime before becoming subject to any gift or estate taxes.

2022 Estate Gift And Gst Tax Exemptions Announced By Irs Nixon Peabody Blog

How The Unified Tax Credit Maximizes Wealth Transfer Blog Jenkins Fenstermaker Pllc

Generation Skipping Trust Gst What It Is And How It Works

Family Loans Should You Lend It Or Give It Away Retirement Plan Services

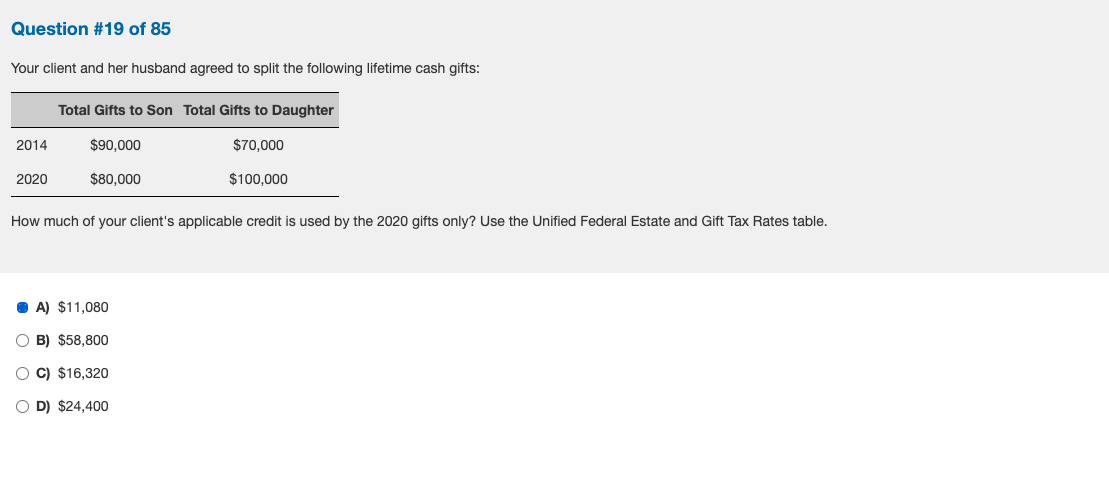

Question 19 Of 85 Your Client And Her Husband Agreed Chegg Com

How Can I Save On Taxes By Gifting Cash To Others

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

Estate Planning 101 Presentation

79 Best Tax Law Books Of All Time Bookauthority

2022 Estate Gift And Gst Tax Exemptions Announced By Irs Nixon Peabody Blog